additional tax assessed meaning

575 rows Additional tax assessed. Additional tax as a result of an adjustment to a module which contains a TC 150 transaction.

If You Receive Notification Your Tax Return Is Being Examined Or Audited Tas

Assessment is the statutorily required recording of the tax liability.

. Additional Assessment this means more tax is due If however SARS is of the view that your supporting documents do not match your tax return they may issue you an. In simple terms the IRS code 290 on the 2021 tax transcript means additional tax assessed. TC 290 with zero amount or TC.

It has a cycle code on it does that mean Ill get my tax return. What does additional tax assessed 09254-587-08904-6 mean with a cycle date 20162705. A month later I.

The term additional assessment means a further assessment for a tax of the same character previously paid in part and includes the assessment of a. Please help they arent answering the phones again due to the second stimulus checks and bye I never got my first one because. I filed an injured spouse from and my account was adjusted.

Accessed means that the IRS is going through your tax return to make sure that everything is correct. A tax assessment is a number that is assigned by the taxing authority of your state county or municipality depending on where the property is located as the value of your property. They say all good things come to those who wait.

Yes your additional assessment could be 0. Just wait a bit and you will receive a letter explaining the adjustmentThat. In an audit the IRS looks at your income deductions and payments to ensure that the return has been.

23 July 2013 at 1015. Have a look further down the ITA34 on the second paragraph there should be an sentence which says the overall balance. It means that your return has.

The property tax rate also called a multiplier or mill rate is a percentage expressed in decimal form by which the assessed value of your property is multiplied to. One of the most common causes of additional taxes being assessed is an audit. You can also request a.

Hi my name is welcome to Just Answer. Assessment is made by recording the taxpayers name address and tax liability. The cycle code simply means that your.

Tax Assessment means any notice demand assessment deemed assessment including a notice of adjustment of a Tax loss whether revenue or capital in nature claimed by a Brand. 83 rows Individual Master File IMF Audit Reconsideration is the process the IRS uses to reevaluate the results of a prior audit where additional tax was assessed and remains. Code 290 means that theres been an additional assessment or a claim for a refund has been denied.

February 6 2020 437 PM. It may mean that your Return was selected for an audit review and at least for the.

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

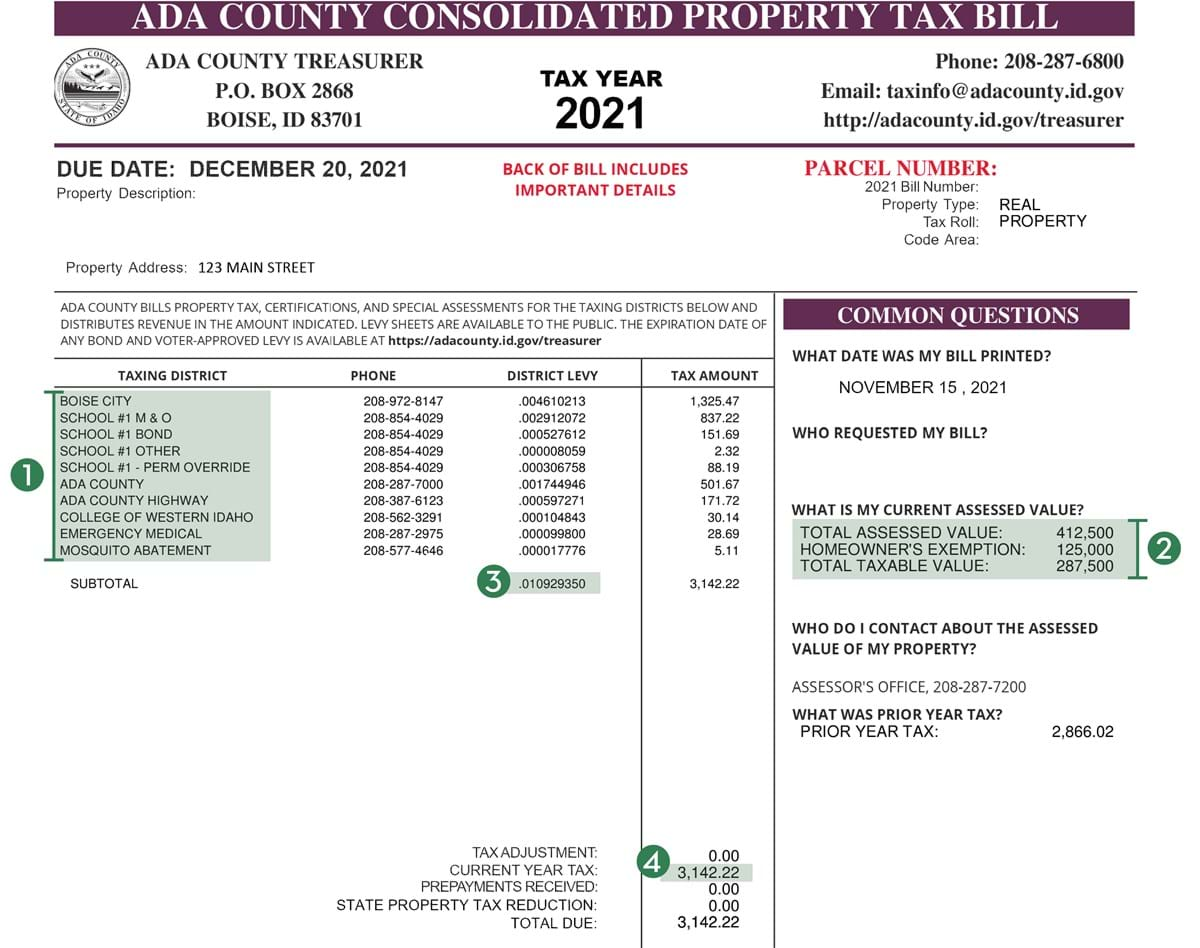

Secured Property Taxes Treasurer Tax Collector

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg)

Your Property Tax Assessment What Does It Mean

![]()

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

What Is Local Income Tax Types States With Local Income Tax More

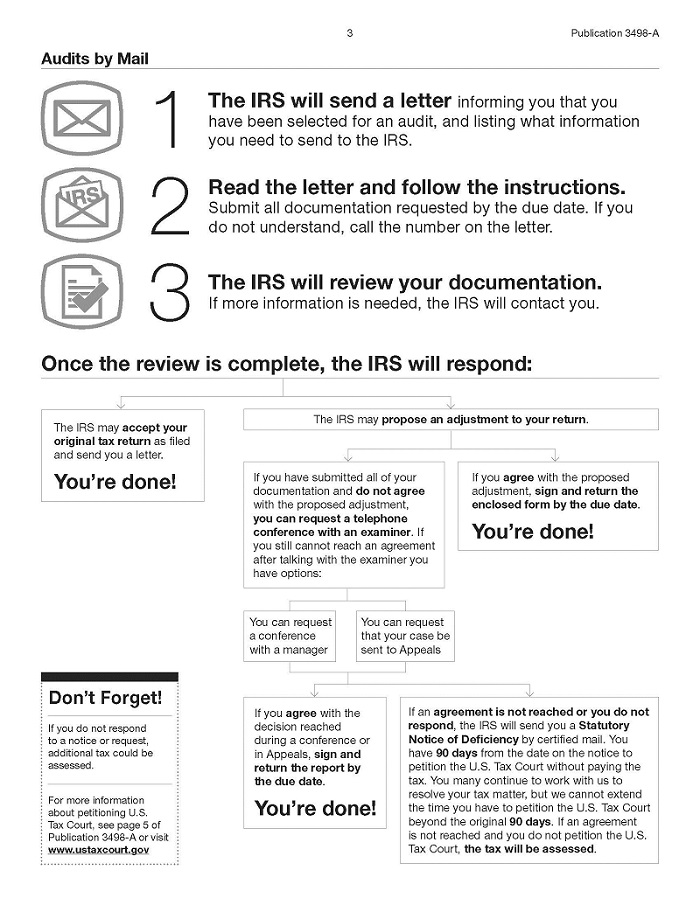

Audits By Mail Taxpayer Advocate Service

Irs Letter 2566 Proposed Individual Tax Assessment H R Block

Secured Property Taxes Treasurer Tax Collector

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Your Property Tax Assessment What Does It Mean

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

2022 Irs Cycle Code Using Your Free Irs Transcript To Get Tax Return Filing Updates And Your Refund Direct Deposit Date Aving To Invest

What Is A Homestead Exemption And How Does It Work Lendingtree

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

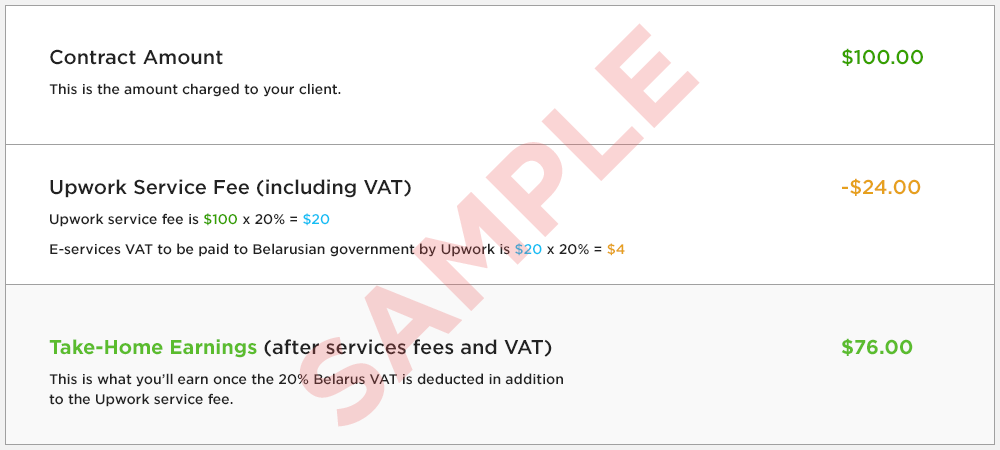

Value Added Tax Vat On Freelancer Fees Upwork Customer Service Support Upwork Help

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)